Riverside Unpaid Wages Attorneys

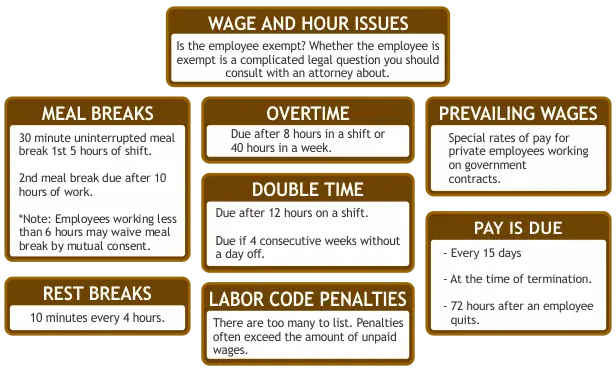

Contact us if you have a question about whether your are owed overtime, double time, commissions, wages, bonus pay, or pay for meal or rest breaks. We want to explain to you what overtime is, what prevailing wage is, and when you are an exempt versus non-exempt employee.

The law concerning unpaid wages is very complicated. There are many exemptions and rules. In addition, unpaid wage law does not come only from only one source. There are Labor Code Sections, DLSE interpretives, California Codes of Regulations, Wage Orders, and other legal principles that apply. There are also great variations between Federal and California laws on unpaid wages.

Overtime cases, meal and rest break cases, unpaid bonus cases, unpaid commission cases, involve labor laws that provide for multiple penalties. The Labor Commission (Department of Labor Standards Enforcement) will probably not pursue penalties for unpaid overtime, unpaid commissions, unpaid bonuses, meal and rest break violations. Nor are they likely to pursue interest for unpaid overtime, unpaid commissions, unpaid meal and rest breaks, or unpaid wages or bonuses.

Call (951) 367-1000 for a Riverside County labor law attorney who will pursue all penalties and interest.

All Statements Made Hereon Assume Many Conditions That May Not Apply. Wage and Hour Law is Very Technical. Please Consult With a Labor Lawyer.

Selected Employment Lawyers Group Unpaid Wage Settlements

$1,150,000 Unpaid commissions of two plaintiffs

$875,000 For 4 oil field service industry workers whose times worked were not recorded on timesheets and were on-call

$800,000 Controlled stand by class action settlement

$800,000 For mis-classified independent contractors

$775,000 For small class action of employees not allowed meal breaks or cell phone reimbursements while caring for dependent adults

$500,000 Unpaid days of work to 4 oil rig workers

$460,000 Unpaid hours of work for security officers & PAGA Violations

$450,000 Settlement for 2 on-call workers

$450,000 Paystub violations

$350,000 To 2 employees in vacation rental business working off-the-clock overtime

* Please be advised that past results are not a guarantee nor prediction of future case results

Minimum Wage in California

In California, the minimum wage is $16.50 per hour. While there are a few exceptions, state law requires employers to pay almost all employees the minimum wage or higher. If you aren't receiving the minimum wage, you may be able to file a claim against your employer. Only an experienced attorney can determine the value of your claim, which may include the wages you are owed, interest, penalties and other damages.

Failure to pay the minimum wage can happen even if technically you are supposed to be paid more than the minimum wage. For example, a worker earning $11 per hour ends up earning less than minimum wage if he or she is required to work 50 hours a week. Ten of those hours must be paid at $16.50 an hour, and if the employee was only paid $440 for the week, that is $275 for 40 hours of work.

At the Employment Lawyers Group, our attorneys have extensive experience litigating unpaid wages cases, including failure to pay the minimum wage. Contact us to discuss your case and explain your options.

Protection for employees: If your employer fires you or punishes you for filing a failure-to-pay minimum wage claim, it may be subject to additional damages. If your employer takes the case to court and loses, it may be required to pay your attorney fees.

Settlements for failing to pay minimum wage can be significant. These are some of our case results for the recovery of minimum wage pay:

$750,000 Sub-Minimum wage class action settlement

$175,000 Failure to pay minimum wage

* Please be advised that past results are not a guarantee nor prediction of future case results

Prevailing Wages in Riverside

An example of one of our case results for prevailing wage $350,000 for prevailing wage violations and and paystub that were not properly itemizations. In another case, $200,000 for prevailing wage and FMLA violations of a Riverside County employee. More than twenty years ago we obtained $109,500 in unpaid prevailing wages for 2 employees of a small company.

If you are employed by a private employer and working on a construction project for a public agency in California, your employer is required by law to pay you the prevailing wage for your services. If you aren't receiving the prevailing wage, you may be able to file a claim against your employer. Only an experienced attorney can determine the value of your prevailing wage claim, which may include the wages you are owed, interest, penalties and other damages.

At the Employment Lawyers Group, our attorneys have extensive experience litigating unpaid wages cases, including failure to pay the prevailing wage. Contact us to discuss your case and explain your options.

What Is the Prevailing Wage?

The prevailing wage is the hourly wage and benefits paid to the majority of workers in a particular area. In California, the amount of the prevailing wage is set by law. Unless your job is entry level, your private employer must pay you the prevailing wage when you work for a city, county, school district, the state or any other public agency.

Protection for employees: If your employer fires you or punishes you for filing a failure-to-pay prevailing wage claim, it may be subject to a wrongful termination lawsuit.

Riverside Overtime Lawyer

With few exceptions, California employers are required to pay you overtime for hours worked in excess of eight in a day. If you aren't receiving overtime when it is due, you may be able to file a claim against your employer. Only an experienced attorney can determine the value of your claim, which may include the wages you are owed, interest, penalties and other damages.

At the Employment Lawyers Group, our attorneys have extensive experience litigating unpaid wages cases, including failure to pay the prevailing wage. Contact us to discuss your case and explain your options.

Call us today at (951) 367-1000 for a Riverside overtime lawyer.

Who Is Exempt From the Overtime Requirement?

In California, there are many industries and professions that are exempt from the overtime requirement. We strongly advise you consult with an attorney on whether you are an exempt or nonexempt employee.

The following are examples of exempt employees:

- Administrative, professional and executive employees

- Certain employees in the computer software field

- Outside salespersons

- The parent, spouse, child or legally adopted child of the employer

- Managers and supervisors who supervise two or more employees 51 percent or more of the time and are paid at least two times the minimum wage

The laws defining administrative, professional or executive employee are often misinterpreted by employers. If you think your position may be misclassified, contact our experienced labor lawyers for an evaluation.

If you work four 10-hour days or three 12-hour days, you are entitled to overtime for all hours worked in a day over eight. Double time is pay to be due for work after the 12th hour of every day.

Protection for employees: If your employer fires you or punishes you for filing a failure-to-pay overtime claim, it may be subject to additional damages. If your employer demands that the overtime case be heard all the way through a court decision, it most likely will be required to pay your attorney fees.

Contact a Riverside Labor AttorneyTo speak to a Riverside overtime lawyer, call (951) 367-1000 . We handle all cases on a contingency fee basis with no upfront costs. Se habla Español.

Lunch Break Laws California

In California, your employer is required by law to provide you with meal and rest breaks. If you aren't receiving these lunch breaks, you may be entitled to compensation from your employer. Only an experienced labor attorney can determine the value of your claim, which may include penalties for missed meal and rest breaks and interest.

At the Employment Lawyers Group, our attorneys have extensive experience litigating violations of labor laws, including the requirement to provide lunch breaks. Contact us to discuss your case and explain your options.

When Am I Entitled to Meal Breaks?

If you work more than five hours a day, you are entitled to an uninterrupted meal break of not less than 30 minutes in which you can leave the premises or do anything you want. This only applies to nonexempt employees. The fact that you are paid hourly or salaried does not determine whether you are exempt. The employee cannot choose not to take the meal break and sue. To file suit, the employer needs to prevent the meal break or the nature of business is such that the employee cannot be relieved to take a meal break.

Your employer does not have to pay you for a meal break as long as you are relieved of all duties and are allowed to leave the work site. If you work more than 10 hours, you are entitled to two uninterrupted meal breaks.

If you are required to remain at your work site during your meal break, you must be paid for the time even if you are relieved of all duties during the meal break unless you have signed a valid meal break waiver or on-duty meal break agreement. Whether meal break waivers are valid is an extremely complicated question of labor law we have experience with having handled this issue in a class action.

When Am I Entitled to Rest Breaks? You are entitled to a 10-minute rest break for every four-hour work period.

Cases for missed meal breaks can result in significant recovery for employees. Some of our case results are:

$400,000 Following arbitration win for meal & rest breaks for 3 employees

$360,000 For missed meal and rest breaks, and overtime for 3 employees, and PAGA penalties for less than 25

* Please be advised that past results are not a guarantee nor prediction of future case results

Protection for employees: If your employer fires you or punishes you for filing a meal break or rest break claim, it may be subject to additional damages.

Contact a Riverside Rest and Lunch Break Attorney The law is very complicated, so what is stated above may not apply to you. To consult a Riverside unpaid meal breaks lawyer, call (951) 367-1000 toll free. We handle all cases on a contingency fee basis with no upfront costs. Se habla Español.

Riverside Unpaid Commissions Attorney

In California, it is illegal for an employer to withhold unpaid commissions and bonuses. If you haven't been paid all of the money you have earned, you may be entitled to compensation. Only an experienced attorney can determine the value of your claim, which may include the pay you are owed, interest, penalties and other damages.

At the Employment Lawyers Group, our attorneys have extensive experience litigating unpaid wages cases, including failure to pay commissions and bonuses. We have had recoveries of over $1,000,000 due to unpaid commissions. Contact us to discuss your unpaid commission case and explain your options.

When Must Commissions and Bonuses Be Paid? As a general rule, your employer is required to pay you a commission or nondiscretionary bonus if you have substantially completed the necessary work to earn the compensation. You are entitled to unpaid commissions and bonuses even if you leave your employer. However, if another employee had to perform substantial duties to complete the commissionable or bonus event, your employer may not have to pay you.

If your employer fails to pay you all of the compensation you have earned at termination or quitting, your employer may have to pay you "waiting time wages." Waiting time wages are a full day's pay for up to 30 days until your employer pays you.

Protection for employees: If your employer fires you or punishes you for filing an unpaid commissions or bonus case, it may be subject to additional damages.

Contact a Wage Claim Lawyer Serving Ontario To speak to a Riverside unpaid commissions attorney, call (951) 367-1000 toll free. We handle all cases on a contingency fee basis with no upfront costs. Se habla Español.

Unpaid Wages California

Your employer is required to pay you for all time worked in California. If you haven't received all of the compensation you deserve, you may be able to file a claim against your employer. Only an experienced attorney can determine the value of your unpaid wage claim, which may include the wages you are owed, interest, penalties and other damages.

At the Employment Lawyers Group, our attorneys have extensive experience litigating unpaid wages cases. Contact us to discuss your case and explain your options.

The information on this page may not be applicable if you are a public employee or a union member or because of a number of other factors. Consult our experienced employment attorneys for information about your wage issue.

Examples of Unpaid Wages

Many employers illegally withhold pay from employees. The following are examples of some of the most frequent violations:

- Asking you to work off the clock

- Charging you for uniforms or other supplies you need to perform your job

- Failure to pay the minimum wage

- Failure to pay overtime or double time

- Failure to pay commissions or bonuses

- Failure to pay for meal breaks when the company requires you to stay on site

- Failure to pay your final wages after termination of your employment

If your employer is willing to cheat you out of all of the compensation you deserve, it may be doing the same to other employees. For this reason, our lawyers often handle unpaid wages claims as class-action lawsuits.

Protection for employees: If your employer fires you or punishes you for filing an unpaid wages case, it may be subject to additional damages. If your employer takes the case to court and loses, it may be required to pay your attorney fees.

California Employees Are Paid For Sleeping

California law regulating what hourly workers must be paid for differs from the Federal Fair Labor Standards Act (FSLA). This is an example of how California law is more favorable than Federal Law which provides the minimum working protections possible for workers.

In California, non-exempt employees who work twenty four hours or more a day must be paid for time sleeping unless a series of circumstances are met. 1) The employer must allow the employee the ability to have uninterrupted sleep for more than five hours. If the employee is free to do what they want during these five hours and they choose not to sleep, the employer does not have to pay them provided the last two criteria are met; 2) the time excluded for uninterrupted sleep cannot be more than eight hours; 3) the employer must furnish adequate sleeping facilities. A room with a bed might constitute adequate sleep facilities, and a motel or hotel would. More interesting questions would be whether a weather proof tent would constitute adequate facilities, and it probably would if the job was somewhere away from normally constructed shelter, but probably not if it was a security officer working at a hospital.

Presuming there is a twenty four or more hour consecutive shift, and all of the above criteria are met, the next question is whether uninterrupted meal breaks are excluded from determining that there is a twenty four hour shift. For instance, if the employee took two half hour, uninterrupted meal breaks only twenty three hours would have been worked. Thus, the rule about being paid to sleep really involves twenty five hour consecutive shifts if the employer has correctly paid the meal breaks.

If the employee's schedule is less than twenty four hours, the employee is not entitled to be paid if they sleep. Questions would exist as to how many uninterrupted meal breaks the employee is entitled to, and how much they should be paid in overtime and double time pay.

What is stated above is the general law. Complications arise if the employee is required to stay on the premises when they sleep. Some positions are exempt from the employee being paid to sleep if an employee is required to live on premises, or stay in the employer's home. Other positions require written agreements for the employer to avoid paying the employee for all hours spent on premises.

There are too many scenarios, exemptions, and industries to write about so it is best to consult with an attorney who is highly skilled and experienced in wage and hour cases. These are not issues a general practitioner would know, and they are not even issues many labor lawyers know off the top of their head. These issues are based upon a variety of different wage orders, California Codes of Regulation, California Statutes and Federal Statutes, Federal cases, and opinion letters. Lawyers familiar with these issues would need a proper law library to answer these questions. This type of information is not available all in one place, and requires the synthesis of information by somebody skilled in this area.

Some of the laws generally governing whether employers have to pay for sleep time are 29 C.F.R. 785.21; 29 C.F.R. 785.22(a); Division of Labor Standards Enforcement Policy and Interpretations Manual (rev. 2009); Wage and Hour Opinion Letter No. 2102 C.C.H. Section 32,944 (1999); Wage and Hour Opinions Letters No. 1929, C.C.H. 32,759 (1998); No. 1559,C .C.H. 31,362 (1981); Aguilar v. Association For Retarded Citizens, 234 Cal.App.3d 21 (1991); Monzon v. Schaefer Ambulance, 224 Cal.App.3d 16 (1990); Service Employees Local 102 v. County of San Diego, 35 F.3d 483 (9th Cir. 1994); General Electric v. Porter, 208 F.2d 805 (9th Cir. 1953); Johnson v. City of Columbia, 949 F.2d 127 (4th Cir. 1991); Hultgren v. County of Lancaster, 913 F.2d 498 (8th Cir. 1990); Van Dyke v. Bluefrield Gas Co., 210 F.2d 620 (4th Cir. 1954); Beaston v. Scotland, 693 F.Supp. 234 (MD Pa. 1988).

Call (951) 367-1000 for a Riverside wage and hour lawyer employees may estimate the number of hours they worked, and were not paid, if the employer has inadequate payroll records.

In every jury trial, the jury is given an instruction on what the law is. If the employer has failed to keep accurate records of the hours that the employee works, or does not bring them to trial, the following jury instruction is read:

State law requires California employers to keep payroll records showing the hours worked by and wages paid to employees. If Defendants have not presented accurate information about the hours worked by the Plaintiff then your decision may be based upon a reasonable estimate of the hours worked, CACI 2703.

Hernandez v. Mendoza, 199 Cal.App.3d 721, 727-728, 245 Cal.Rptr. 36 (1988) is in accord with federal precedent stating and states:

Although the employee has the burden of proving that he performed work for which he was not compensated, public policy prohibits making that burden an impossible hurdle for the employee...'In such situation...and employee has carried out his burden if he proves that he has in fact performed work for which he was improperly compensated and if he produces sufficient evidence to show the amount and extent of that work as a matter of just and reasonable inference. The burden then shifts to the employer to come forward with evidence of the precise amount of work performed with evidence to negative the reasonableness of the inference to be drawn from the employee's evidence. if the employer fails to produce such evidence, the court may then award damages to the employee, even though the result be only approximate.'

Do not be afraid to file a lawsuit for unpaid wages, including overtime, if you or your employer do not have completely accurate records of the times you worked such as through time cards. However, do not exaggerate your claims of hours worked.

If you have questions about whether you should be paid when you work a twenty four hour, or shorter shift, please feel free to contact us.

Call us today at (951) 367-1000 for a Riverside wage and hour lawyer - California Off-the-Clock Wage Attorney

In California, it is illegal for your employer to ask you to work off the clock. If your employer has asked you not to report all of the hours that you work, you may be able to file a claim against your employer. Only an experienced attorney can determine the value of your claim, which may include the wages you are owed, interest, penalties and other damages.

At the Employment Lawyers Group, our attorneys have extensive experience litigating unpaid wages cases, including working off the clock. Contact us to discuss your case and explain your options.

What Is Working Off the Clock? Working off the clock occurs when your employer asks you not to report all of the hours you work. Here are some examples:

- Your employer asks you not to report preparation time.

- Your employer asks you not to report time worked on the weekend such as time when you are on call.

- Your employer asks you not to report time that would result in overtime pay.

- Your employer asks you not to report meal breaks as time worked when you are required to remain on site.

If your employer does not pay you for all of the hours you work, you have two choices:

- You can file a claim with the California Division of Labor Standards Enforcement

- You can retain a lawyer and file a lawsuit in civil court

In most cases, it pays to hire an attorney to handle your case. Only an attorney knows all of the remedies, statutory fines and penalties that may be available to you. If your employer takes the case to court and loses, it may also have to pay your attorney fees. If your employer fires you or punishes you for filing an unpaid wages claim, it may be subject to additional damages and a wrongful termination case.

Contact an Unpaid Wage Lawyer Serving Moreno Valley

If you think you deserve rightful compensation for unpaid wages, you may have a case that we can handle. There are many rules and regulations you may not understand, so we are here to help. Proudly Representing Employees In: Banning, Beaumont, Blythe, Cathedral City, Coachella, Corona, Hemet, Indio, Jurupa Valley, Lake Elsinore, La Quinta, Menifee, Moreno Valley, Murrieta, Norco, Palm Desert, Palm Springs, Perris, Rancho Mirage, Riverside, San Jacinoto, Temecula.

To speak to a Riverside wage claim attorney, call (951) 367-1000 toll free. We handle all cases on a contingency fee basis with no upfront costs. Se habla Español.

Our Firm: No upfront fees or costs

Contingency Fee Representation

All employment cases for employees are taken on a contingency basis. We are only paid a fee when and if we win your case, and we advance all litigation costs. Our goal is to make expert legal representation accessible to every hardworking employee.

Serving Riverside County

We have proudly served all of Riverside County since 1993.

The Employment Lawyers Group has successfully handled

2,000+

Separate California Employment Cases

Media Engagements

Sample Case Results

Employment Case

$18,402,868

Jury verdict for male visually harassed and subject to crude comments by a female manager

breach of commission contract

$1,150,000

Unpaid commissions of two plaintiffs

unpaid wages

$875,000

For 4 oil field service industry workers whose times worked were not recorded on timesheets and were on-call

Disclaimer: These results are based on the facts of these specific cases and do not guarantee or predict a similar result in any future case.

Practice Areas

Discrimination

Age, Disability, Family Medical Leave (FMLA/CFRA), Gender, National Origin, Pregnancy, Race, and Sexual Orientation claims.

Unpaid Wages & Overtime

Recovering earnings for Overtime, Bonuses, Commissions, Meal & Rest Breaks, and Prevailing Wage violations.

Sexual Harassment

Compassionate and effective representation for victims of sexual harassment and hostile work environment claims.

Wrongful Termination

Representing employees terminated in violation of public policy, contracts, or California and Federal law.

Leaves & Retaliation

Protecting employees who face adverse actions after reporting illegal activity or taking protected medical leave.

Whistleblowers

Advocating for employees who report fraud, waste, or abuse in their organizations under whistleblower protections.

Our California Locations

![]() Bakersfield

Bakersfield

5401 Business Park S, #214,

Bakersfield CA 93309

![]() Sacramento

Sacramento

777 Campus Commons Rd, #200,

Sacramento CA 95825

![]() San Francisco

San Francisco

524 Union St, #400,

San Francisco CA 94133

Additional Sites

About Firm Founder, Karl Gerber

Firm Founder, Karl Gerber, has been an employment wrongful termination attorney since 1993. He has represented a wide range of employees throughout California.

Mr. Gerber has won 51 of the binding arbitrations and jury trials he first chaired, and a number of his appeals are published. This deep trial experience is the foundation of the firm's strategic approach to litigation.

The employment attorneys employed by the Employment Lawyers Group have worked at the firm well in excess of five years, have also tried many different labor cases, and have all been extensively trained on employment wrongful termination by Karl Gerber.

Ready to Discuss Your Case?

Your rights as an employee matter. Contact us for a free, confidential case review.

Contact Us

Share Your Workplace Situation Directly With Our Attorneys Via This Form.